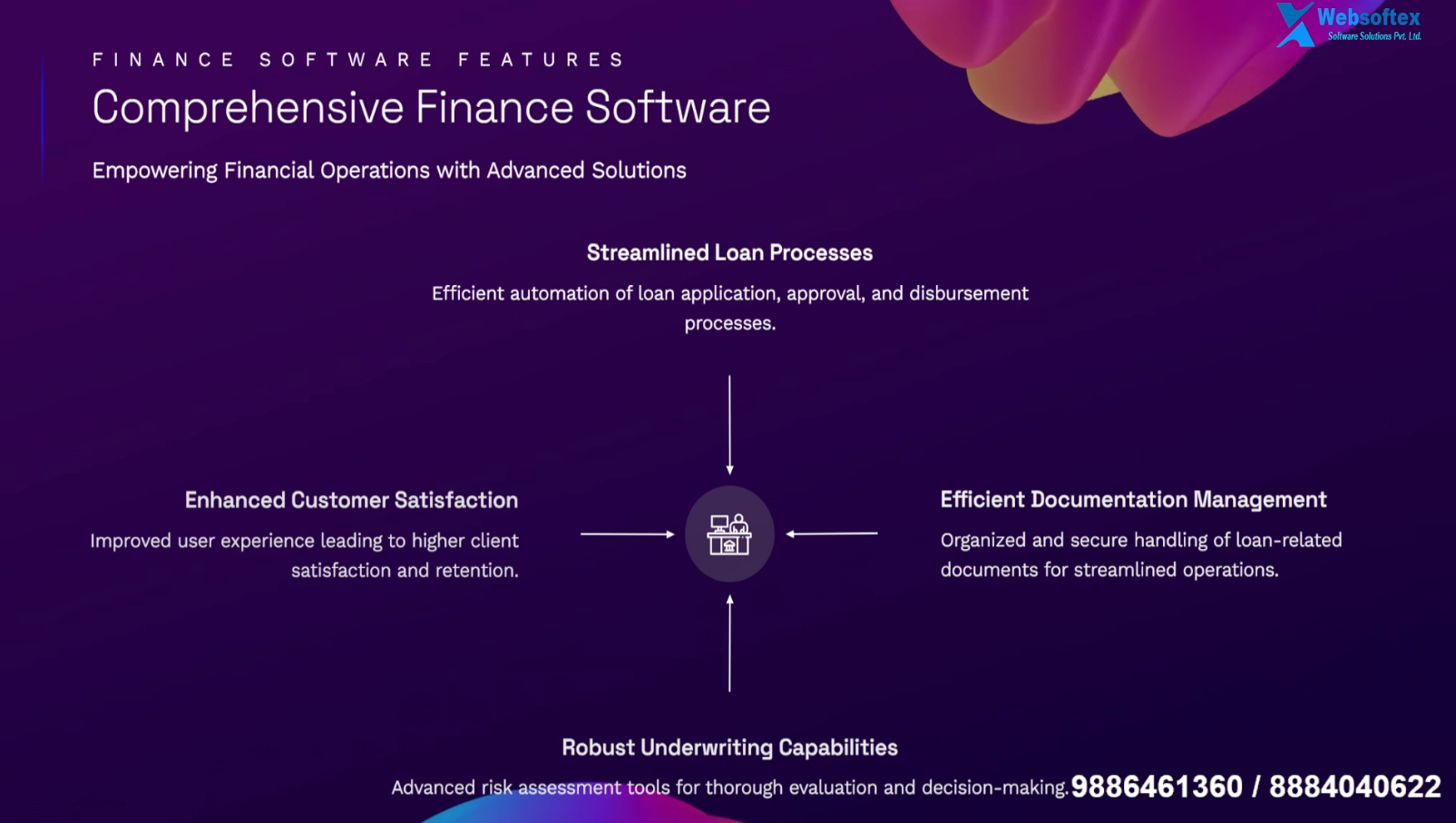

Empowering Financial Operations with Advanced Solutions

Streamlined Loan Processes: Efficient automation of loan application, approval, and disbursement processes.

Efficient Documentation Management: Organized and secure handling of loan-related documents for streamlined operations.

Robust Underwriting Capabilities. Advanced risk assessment tools for thorough evaluation and decision-making.

Enhanced Customer Satisfaction. Improved user experience leading to higher client satisfaction and retention.

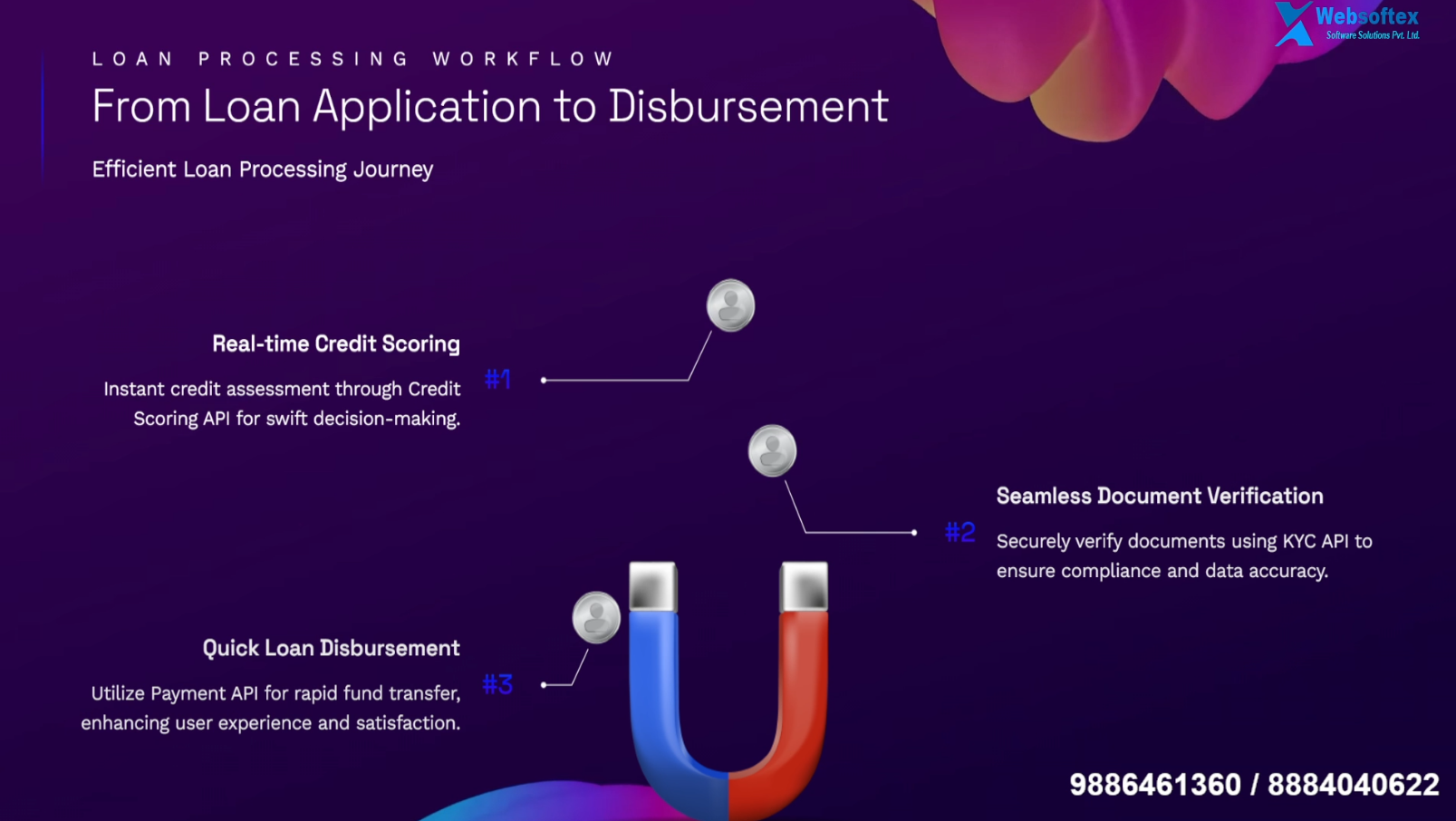

From Loan Application to Disbursement

Efficient Loan Processing Journey.

Real-time Credit Scoring: Instant credit assessment through Credit Scoring API for swift decision-making.

Seamless Document Verification: Securely verify documents using KYC API to ensure compliance and data accuracy.

Quick Loan Disbursement: Utilize Payment API for rapid fund transfer, enhancing user experience and satisfaction.

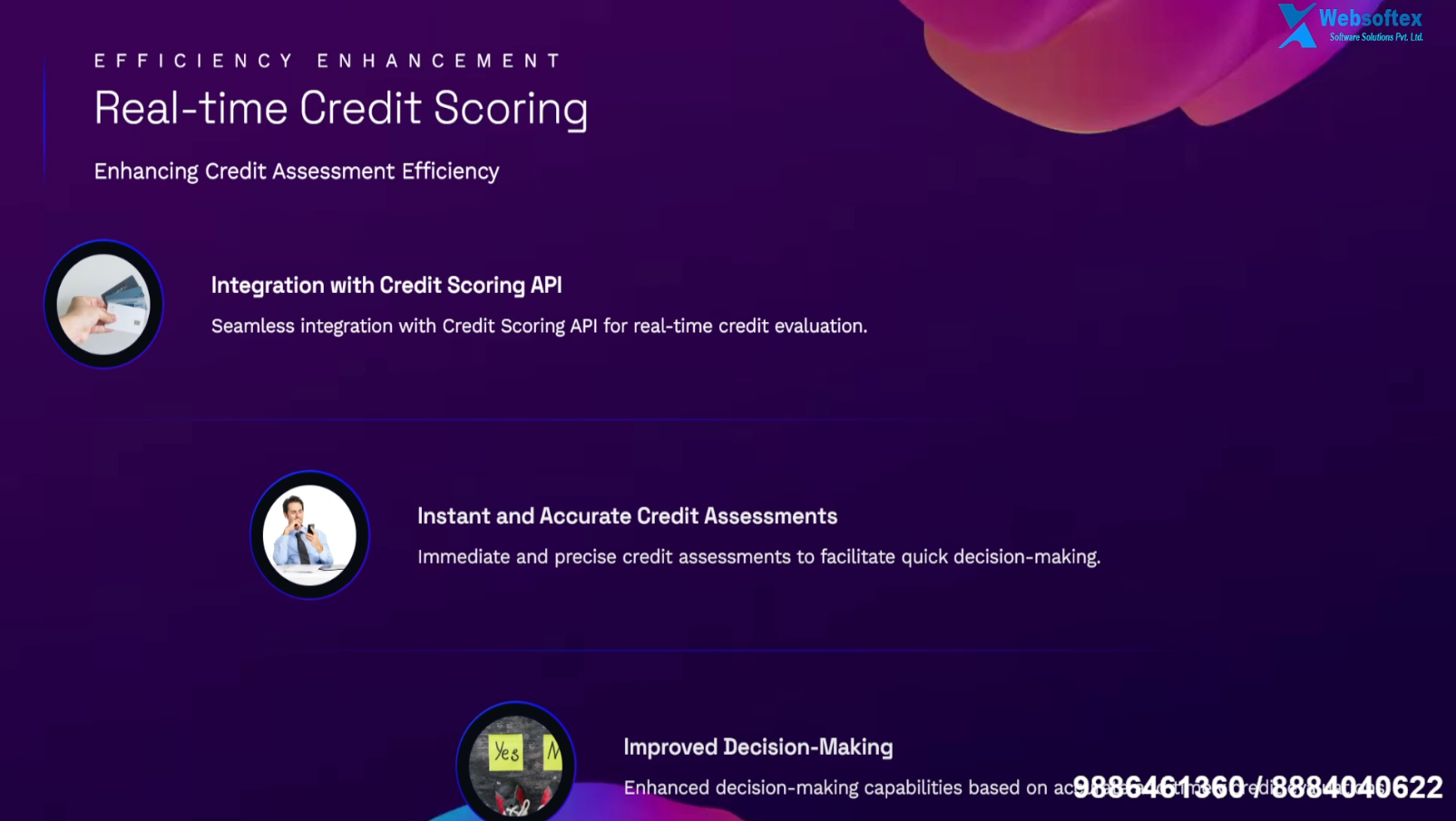

Real-time Credit Scoring

Integration with Credit Scoring API: Seamless integration with Credit Scoring API for real-time credit evaluation.

Instant and Accurate Credit Assessments: Immediate and precise credit assessments to facilitate quick decision-making.

Improved Decision-Making: Enhanced decision-making capabilities based on accurate and timely credit evaluations.

Seamless Document Verification

Enhancing Efficiency and Security in Verification Processes.

KYC API Integration:Integrating KYC API for accurate and efficient customer verification.

Fast and Secure Verification: Ensuring fast and secure verification processes to expedite loan approvals.

Compliance Assurance: Guaranteeing compliance with regulations through robust verification procedures.

Efficient Loan Documentation Process.

Enhancing Documentation Efficiency.

Accurate Data Collection: Efficient data gathering through user-friendly mobile apps and online form submission.

Verification and Validation: Seamless verification and validation process utilizing advanced KYC API for enhanced accuracy.

Compliance Check: Ensuring adherence to regulations and standards for minimized legal risks and enhanced compliance.

Document Segregation

Efficient Management of Documents.

Organized Documentation: Structured arrangement of all financial documents for easy access and retrieval.

Easy Retrieval: Simple and quick access to specific documents when needed, enhancing operational efficiency.

Efficient Management: Effective handling and control of documents to streamline processes and improve productivity.

Accurate Data Collection

Enhancing Data Accuracy through Modern Solutions

Mobile Apps for Data Entry: Utilize user-friendly mobile applications to efficiently collect data from clients and streamline the information input process.

Online Form Integration: Integrate online forms into the data collection process, enabling users to submit information digitally for easier processing and reducing manual errors.

Reducing Errors:Implement advanced data collection methods to minimize errors, ensuring the accuracy and reliability of the information gathered for improved decision-making.

Verification and Validation

Ensuring Data Accuracy and Trustworthiness

KYC API Utilization: Integration with Know Your Customer (KYC) API for verifying customer identities and ensuring compliance.

Data Accuracy: Ensuring the accuracy and integrity of data inputs, minimizing errors and enhancing decision-making.

Trust Enhancement: Building trust with stakeholders by validating data authenticity and maintaining high standards of security and compliance.

Compliance Check

Ensuring Regulatory Compliance and Risk Mitigation

Adhering to Regulations: Strictly following legal requirements and industry standards to guarantee compliance.

Minimizing Legal Risks: Reducing exposure to legal liabilities and ensuring legal conformity to prevent risks.

Maintaining Standards: Upkeeping established norms and practices to uphold operational excellence and credibility.

Audit Trail Maintenance

Ensuring Accountability and Transparency

CPA Login Access: Granting authorized access to Certified Public Accountants for monitoring and oversight.

Transparency and Accountability : Promoting openness and responsibility in financial operations to stakeholders and regulatory bodies.

Detailed Record Keeping: Maintaining a comprehensive and organized log of all financial transactions and activities for auditing purposes.

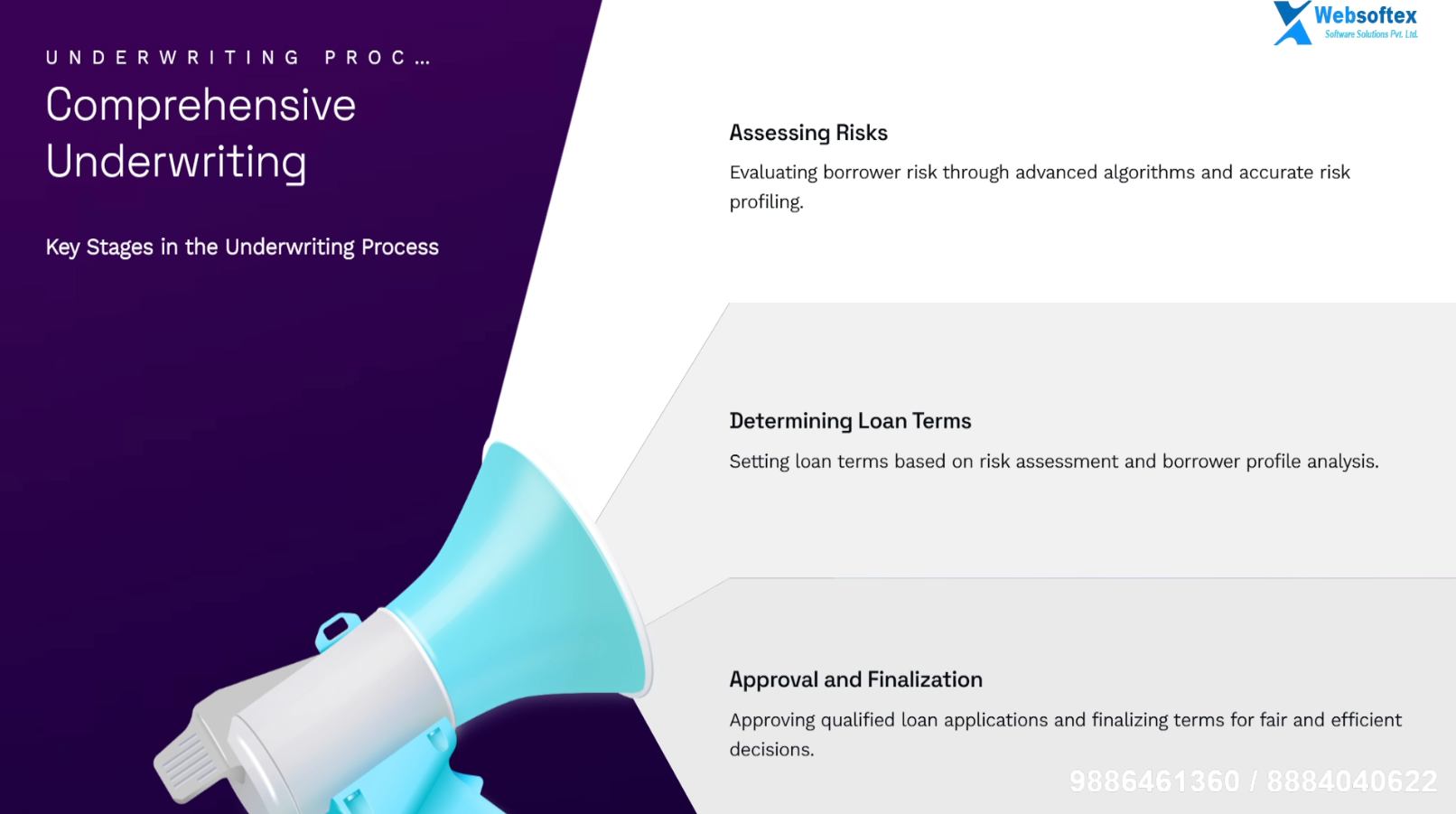

Comprehensive Underwriting

Key Stages in the Underwriting Process

Determining Loan Terms: Setting loan terms based on risk assessment and borrower profile analysis.

Approval and Finalization: Promoting openness and responsibility in financial operations to stakeholders and regulatory bodies.

Detailed Record Keeping: Approving qualified loan applications and finalizing terms for fair and efficient decisions.

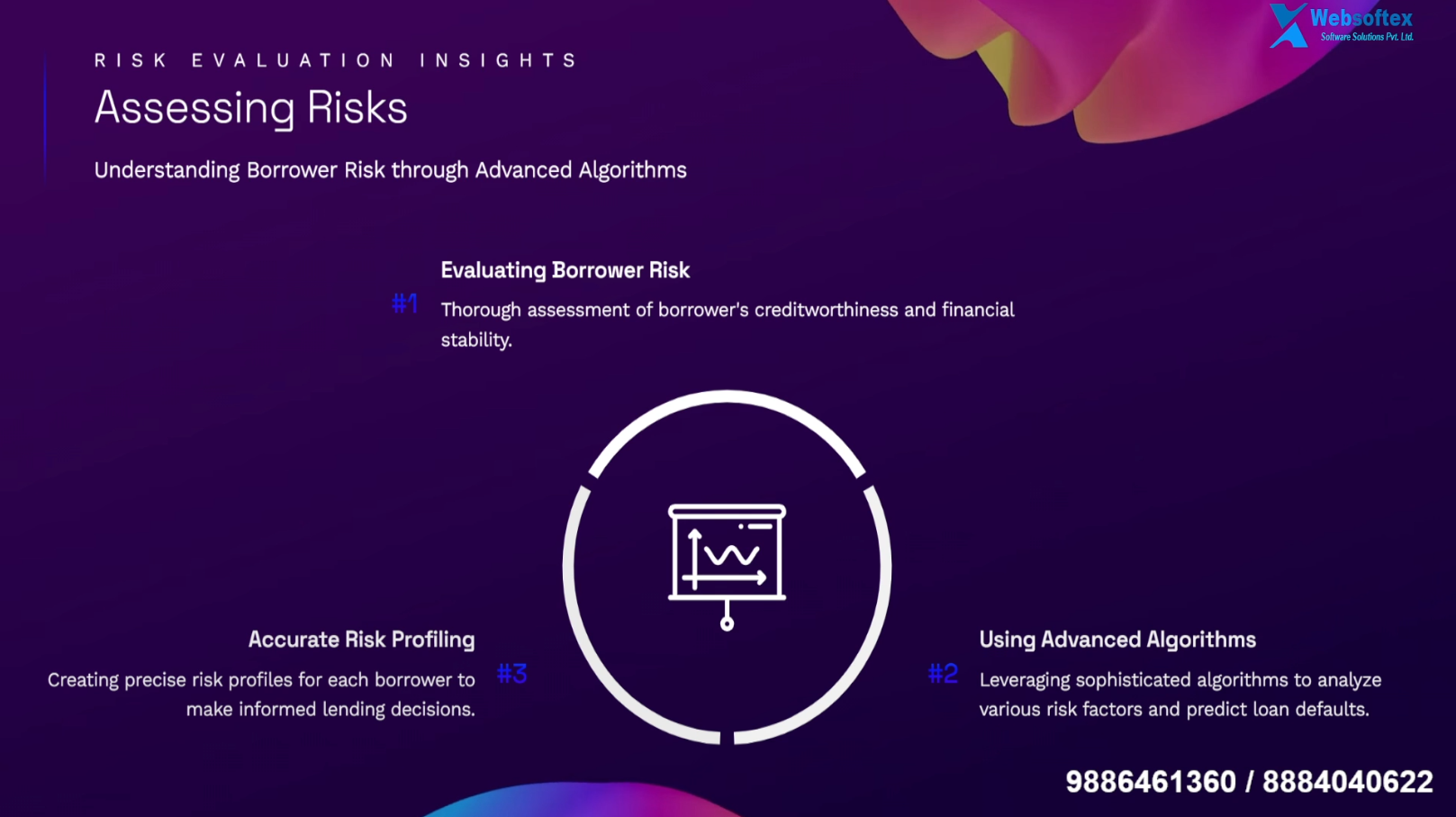

Assessing Risks

Understanding Borrower Risk through Advanced Algorithms

Evaluating Borrower Risk: Thorough assessment of borrower's creditworthiness and financial stability.

Using Advanced Algorithms: Leveraging sophisticated algorithms to analyze various risk factors and predict loan defaults.

Accurate Risk Profiling: Creating precise risk profiles for each borrower to make informed lending decisions.

Loan Approval

Key Steps in the Loan Approval Process

Approving Qualified Applications: This step involves reviewing and accepting loan applications that meet specific criteria and standards set by the financial institution.

Finalizing Loan Terms: Finalizing the specific terms of the loan agreement, including interest rates, repayment schedules, and other relevant conditions agreed upon by both parties.

Ensuring Fair Decisions: Ensuring that the loan approval process is transparent, unbiased, and based on objective evaluation criteria to maintain fairness and integrity in decision-making.

Quick Loan Disbursement

Efficient Fund Transfers and Enhanced User Satisfaction

Payment API Integration: Integration of advanced Payment API for efficient fund transfers.

Speedy Fund Transfer: Swift and secure fund transfer process to borrowers.

Enhanced User Experience: Improving user satisfaction through quick and seamless fund disbursement.

Efficient Loan Disbursement Process

Enhancing Customer Experience

Automation of Disbursement: Utilizing Payment API for streamlined fund transfer.

Real-time Updates: Instant notifications on loan disbursement status.

Enhanced Security Measures: Implementing robust security protocols for safe transactions.

Seamless Integration with Banking Systems: Ensuring smooth interaction with banking platforms.

Loan Disbursement

Efficient Fund Transfer Process

Fund Transfer to Borrower Accounts: Instant transfer of approved loan funds to borrower accounts for quick access and utilization.

Efficient Utilization: Facilitating borrowers in effectively utilizing disbursed funds for intended purposes, leading to enhanced financial management.

Secure Transactions: Ensuring secure and encrypted transactions during the entire loan disbursement process to safeguard financial data and prevent unauthorized access.

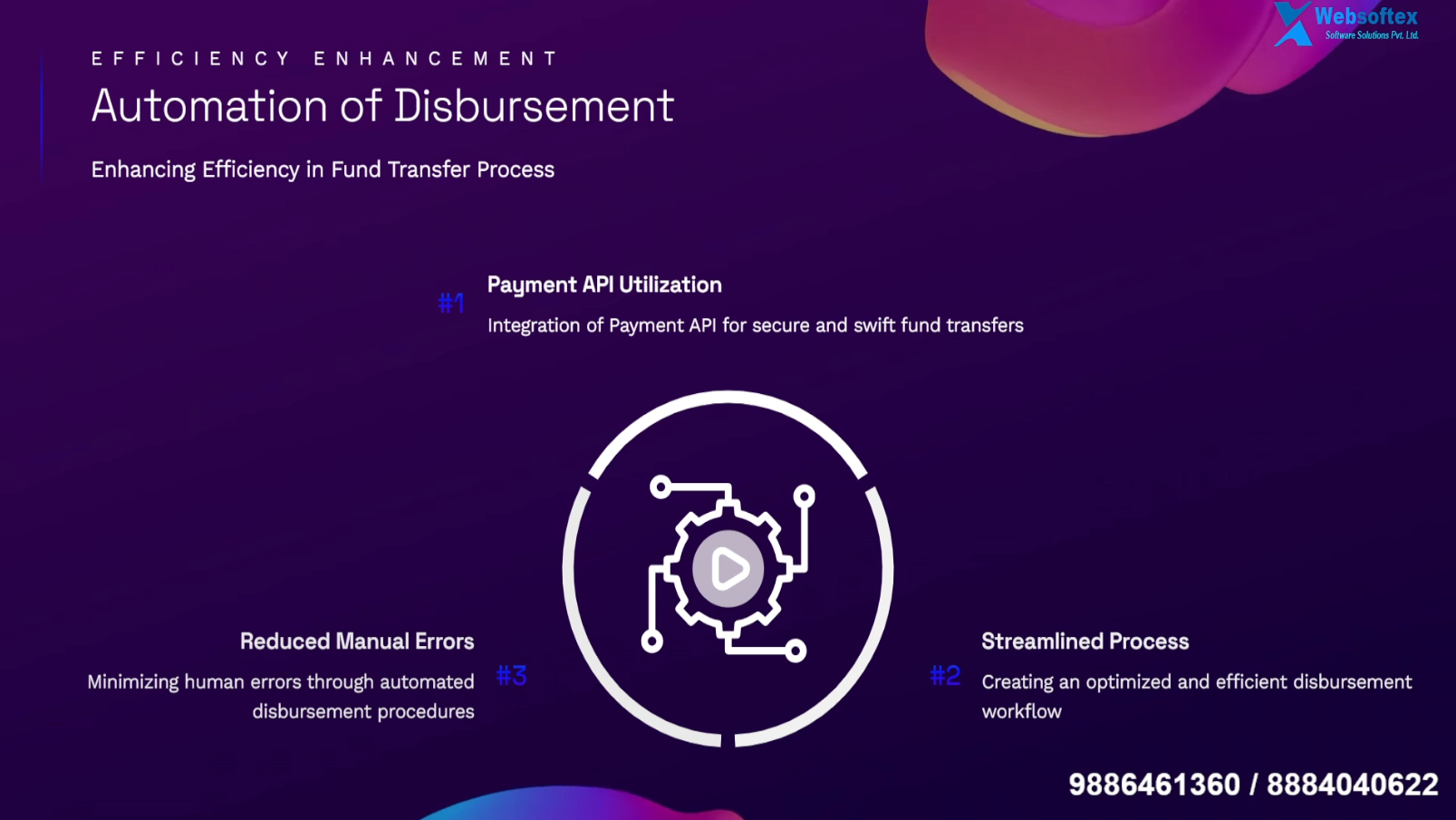

Automation of Disbursement

Enhancing Efficiency in Fund Transfer Process

Payment API Utilization: Integration of Payment API for secure and swift fund transfers.

Streamlined Process: Creating an optimized and efficient disbursement workflow.

Reduced Manual Errors: Minimizing human errors through automated disbursement procedures.

Cutting-edge Solutions.

Cutting-edge Solutions.

Enhancing Efficiency.

Enhancing Efficiency.

Ensuring Security.

Ensuring Security.

Boosting Customer Satisfaction.

Boosting Customer Satisfaction.

.jpg)