"Websoftex Web Based Online SHG Microfinance

Software

Beyond Your Understanding"

Your Favorite Source of SHG Microfinance Software in Bangalore

A self-help group (SHG) is a village-based

financial intermediary committee usually composed of 10–200 local women or men. A mixed group is generally

not preferred.

Members also make small regular savings contributions over a few months until there is enough money in the

group to begin lending. Funds may then be lent back to the members or to others in the village for any

purpose. In India, many SHGs are 'linked' to banks for the delivery of micro-credit. They pool their

resources to become financially stable, taking loans from the money collected by that group and by making

everybody in that group self-employed.

Joint Liability Group (JLG) is a concept established in India in 2014 by

the rural development agency National Bank for Agriculture and Rural Development (NABARD) to provide

institutional credit to small farmers.

Joint Liability Group is a group of 4-10 people of same village/locality of homogenous nature and of same

Socio Economic Background who mutually come together to form a group for the purpose of availing loan from

a bank without any collateral.

Purpose of JLG microfinance is to Provide Credit to Small and Marginal Farmers, Tenant Farmers, Oral

Lessee, Landless Labourers and Artisans and to provide self-employment and increase production of

agricultural products. It provides Collateral free Loan to Groups

Some features of JLGs

- Members should have a common activity.

- Members need not to have a land title.

- Members should be of the same village.

- Only One member of a family can become a member of JLGs.

- Members should not be a defaulter of bank loan.

- Member should hold regular meetings.

Key Features of Software

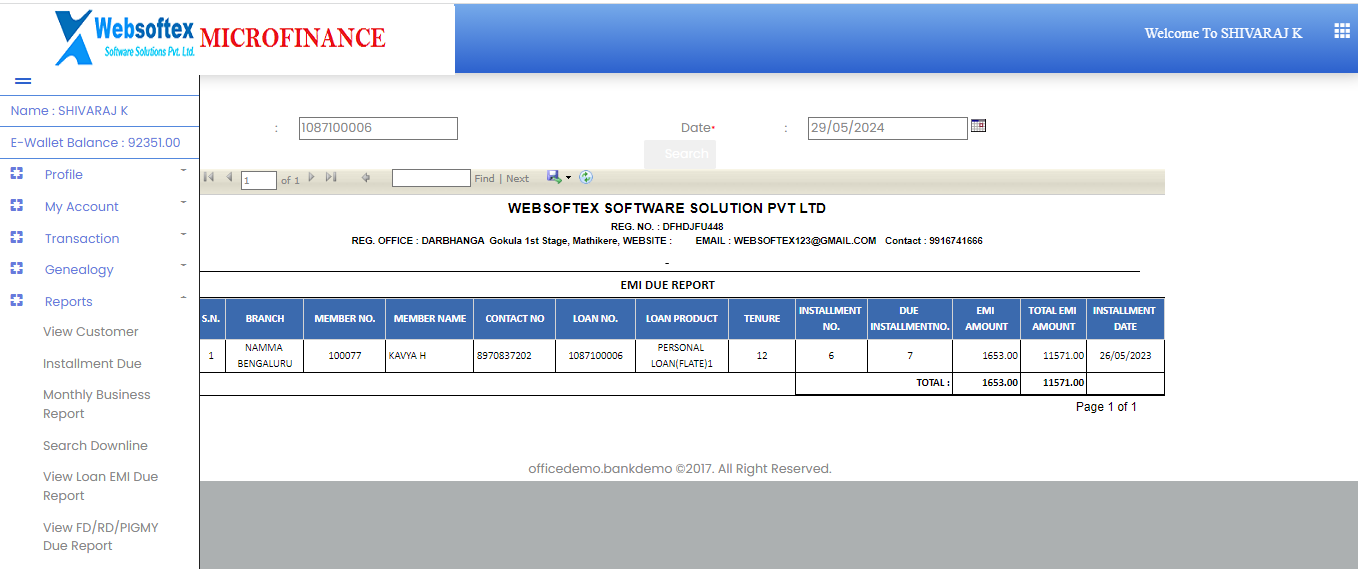

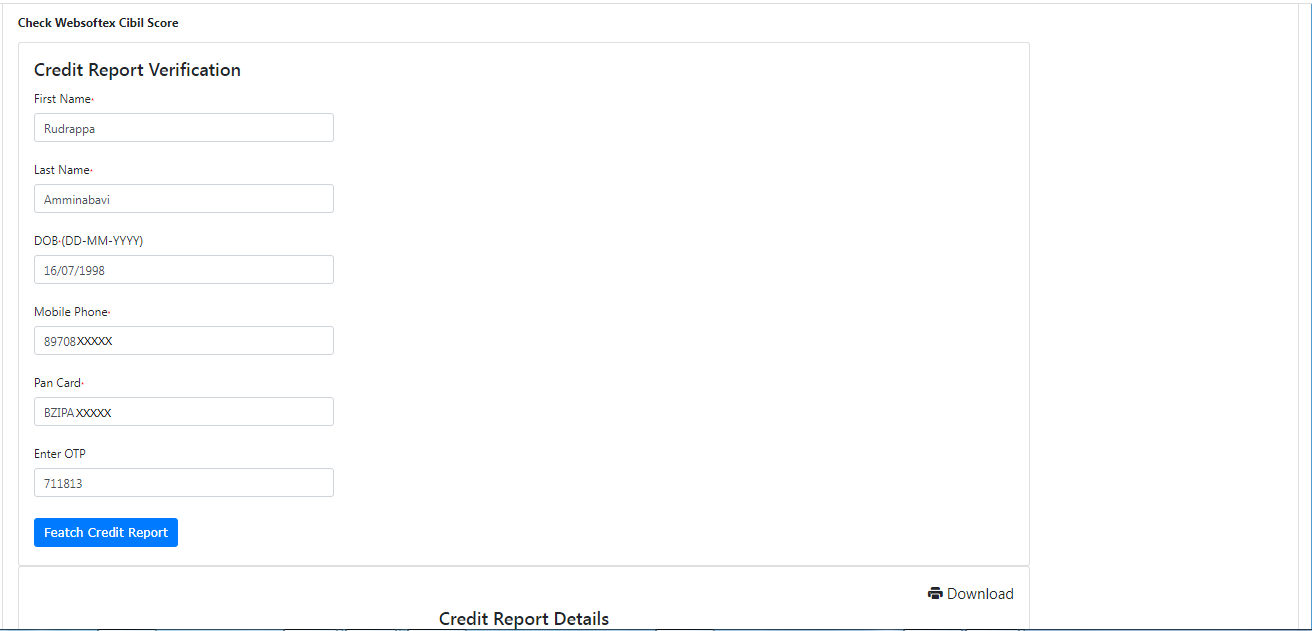

- This software is a complete solution to automate your SHG/JLG Microfinance Software finance or pawn broking finance business.

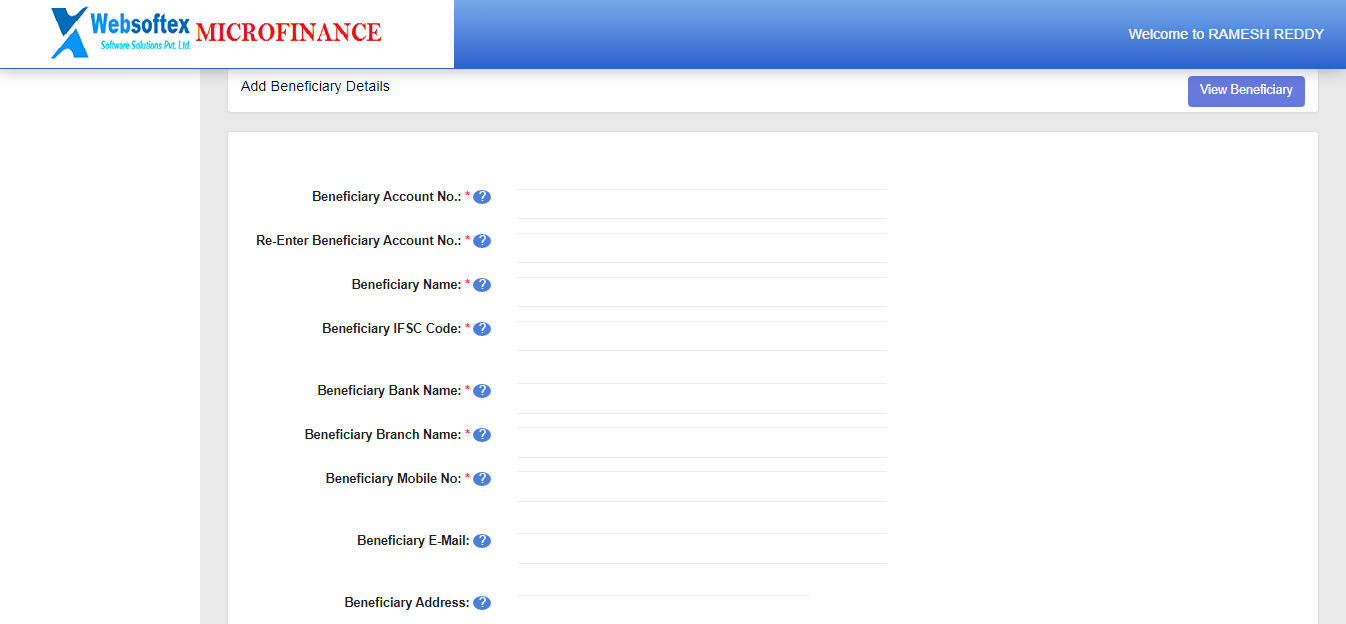

- In this software you can record full information regarding every Loan. Information includes Customer and Guarantors, as well as financial details, current status, Interest schedule, previous loan details, letters, loan transactions, and notes. Thus all information is easily accessible.

- This software can produce Letters regarding overdue and auctioning of arrears, reminders etc.

- Easily track your pledged item inventory and customer information in one place.

- Comprehensive, flexible and user-friendly reports, in various formats export to excel and Pdf formats, Print to Graphic or Draft.

- Simple and Multiple Interest Scheme types and payment options.

- This Software produces multiple Receipts at the same time.

Key Business Benefits

- Maximize accuracy, thus increase the profit for business and reduce losses.

- Reduce Manual work, Increase your time to think creatively.

- Improved profitability, productivity, efficiency and competitiveness.

- Advanced search option makes easy to find key information fast.

- Software helps to keep all customer information in one place.

- Better and more improved customer service levels satisfaction.

- Overall improvement in business reporting and management.

- Integrated accounting management helps to avoid the audit submitting process.

- Accuracy in interest calculation that keep away from man made errors.

Web & Mobile Based

User Friendly

Robust & secure

.jpg)