"Websoftex Web Based Online DSA Loan

Software

Beyond Your Understanding"

Your Favorite Source of DSA Loan Software in Bally

DSA Software Empower Your

Business and Maximize Growth.

If you're running a DSA (Direct Selling Agent) business, you understand the importance of

expanding your

DSA network. The more DSAs you have in your company, the greater your potential for success.

However,

providing individual websites for each DSA can be an expensive and time-consuming endeavor.

That's where

our revolutionary DSA Software comes in.

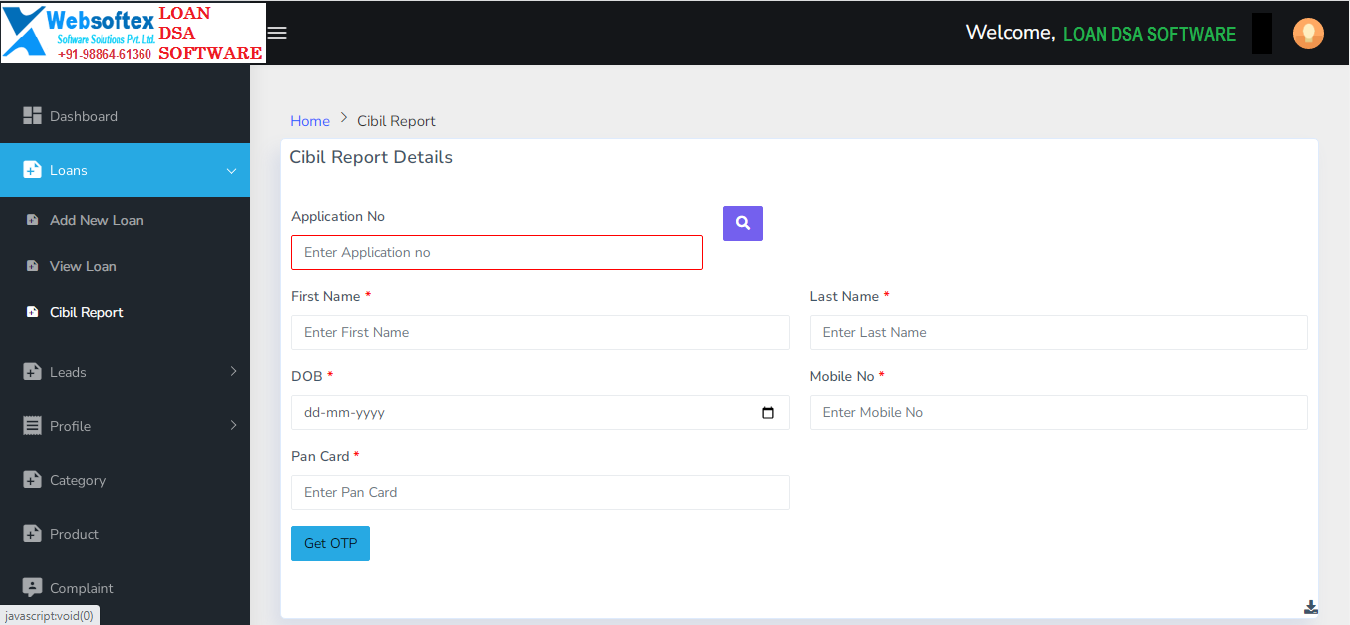

Introducing DSA Software: Simplifying Lead Generation and

Management

At Websoftex DSA Software, we recognize the need for an efficient and cost-effective

solution to empower

your DSA network. Our DSA Software is designed to streamline your operations, enhance lead

generation, and

provide comprehensive loan lead management systems - all in one powerful platform.

Web & Mobile Based

User Friendly

Robust & secure

.jpg)